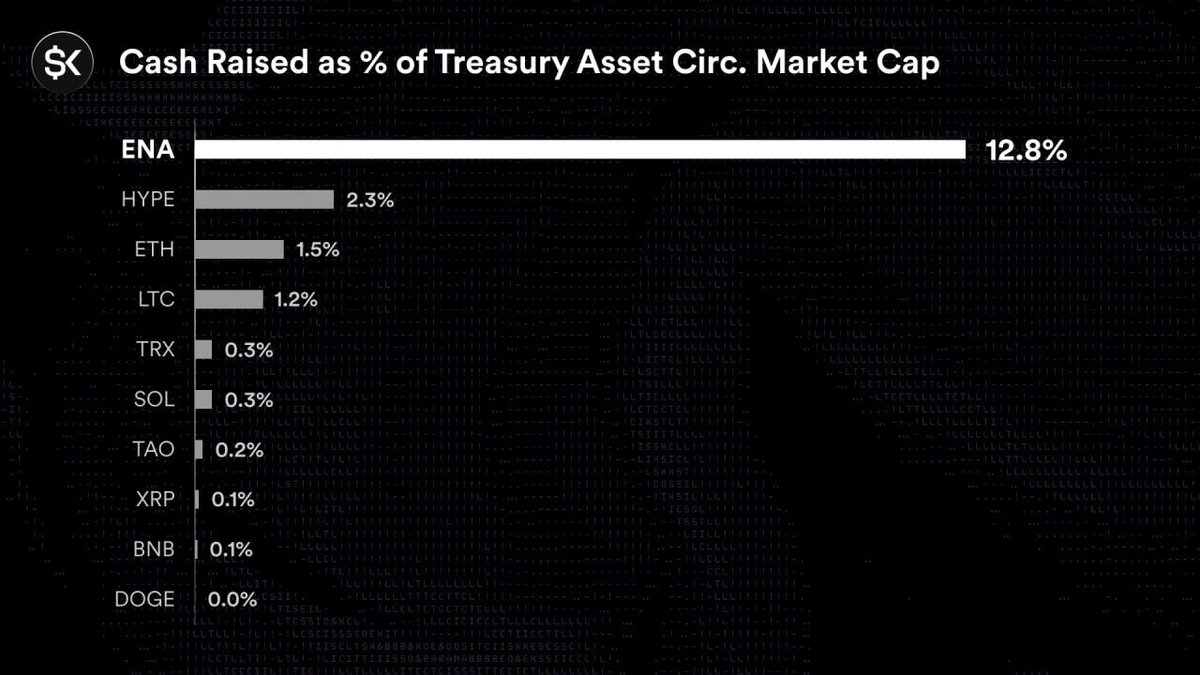

$895M raised to buy $ENA is the equivalent of Saylor raising ~$300b to buy BTC or Tom Lee raising ~$75b to buy ETH (h/t @gdog97_).

Think it’s best bears get out the way.

StablecoinX Inc. @stablecoin_x has announced an additional $530 million capital raise as part of its $ENA accumulation strategy.

To date, StablecoinX has raised a total of approximately $895M in PIPE financing, which is expected to result in a vehicle with over 3 billion ENA tokens on its balance sheet at closing.

This enhanced scale enables greater access to additional institutional channels, broader investor and third-party coverage, and the capacity to hire top tier leadership.

As with the initial PIPE raise, the cash raised via the PIPE will be used by StablecoinX to acquire tokens from a subsidiary of the Ethena Foundation.

The Ethena Foundation subsidiary will initiate an approximately $310 million buyback program over the next 6-8 weeks via third party market makers, reinforcing the alignment between the Foundation and StablecoinX shareholders.

The expected deployment rate of purchases is outlined in the section below this tweet, and is incremental to the buyback program from the initial PIPE financing transaction which has now been completed.

At current prices, the planned buyback program of this second PIPE transaction combined with the liquid ENA contributed to the PIPE by third party investors represents roughly 13% of circulating supply.

This is in addition to the initial PIPE financing which resulted in the acquisition of approximately 7.3% of circulating token supply over the last 6 weeks.

Importantly, as with the initial PIPE raise, the Ethena Foundation has the right to veto any sales of $ENA by StableCoinX at its sole discretion.

Once again, to the extent StablecoinX subsequently raises capital with the intent of purchasing additional locked ENA from the Ethena Foundation or its affiliates, cash proceeds from those token sales are planned to be used to purchase spot $ENA.

StablecoinX's treasury strategy is a deliberate, multi‑year capital allocation strategy that will enables StablecoinX to capture the enormous value of the secular surge in demand for digital dollars while compounding ENA per share to the benefit of shareholders.

25.31K

62

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.