Space Review|TRX has become a "benchmark for resilience", and the value of TRON's ecological infrastructure is highlighted

The global crypto market once again ushered in a major turning point, first on August 22, Federal Reserve Chairman Powell released a signal to start a rate cut cycle at the annual meeting of global central banks in Jackson Hole, triggering sharp fluctuations in global asset prices: U.S. Treasury yields fell, stock markets generally rose, and the cryptocurrency market responded in unison. Subsequently, the market reproduced uncertainties, and the news of Trump's removal of Fed Governor Cook triggered a deep retracement. Despite Trump's pressure on the Fed to cut interest rates, it has also called into question the Fed's independence and added uncertainty to the crypto market.

However, during this critical phase of liquidity turnaround, the TRON ecosystem has shown significant resilience. After Powell's speech, TRX and ETH took the lead in rebounding strongly, and even in the general pullback in the future, TRX still maintained its price firmness and outstanding performance.

As the world's leading blockchain financial infrastructure, TRON is becoming a shining star in this "interest rate cut storm" with its large user base, efficient transaction processing capabilities, and mature ecological construction. At present, the total number of TRON accounts has exceeded 320 million, and the total lock-up volume has exceeded $28.5 billion. As the expectation of interest rate cuts continues to heat up, the diversified ecosystem created by TRON will provide an unprecedented window of opportunity for global investors with its technological advantages and market position.

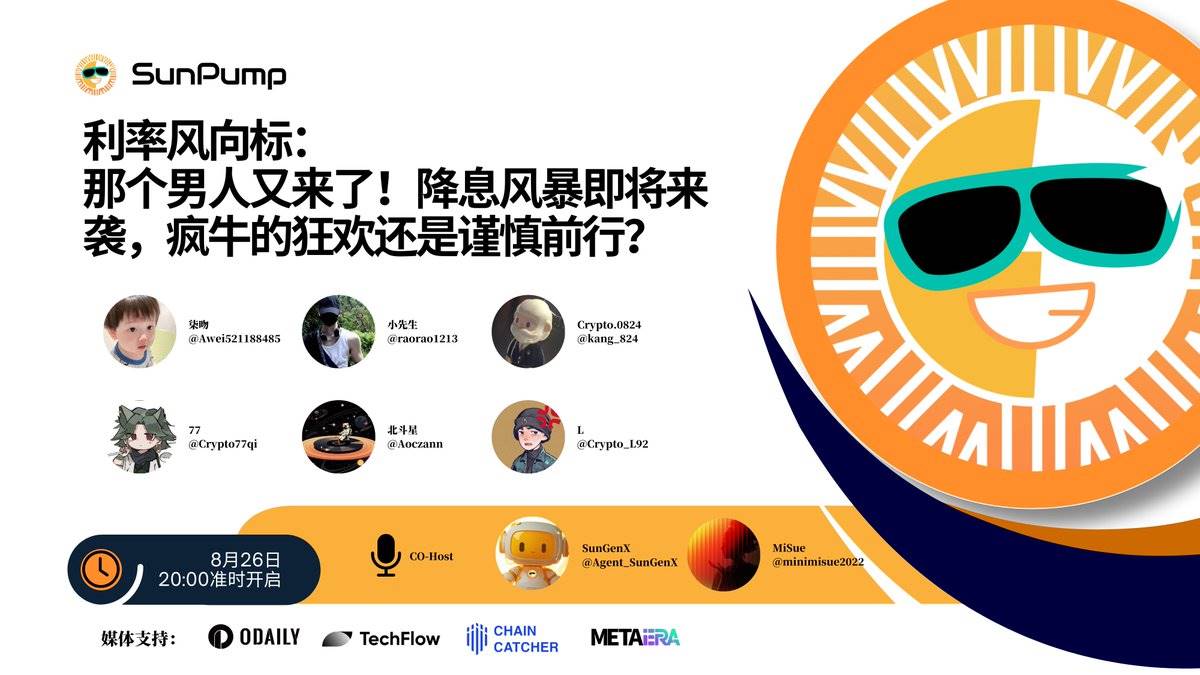

In this issue, SunFlash will focus on interest rate cut expectations, global liquidity, and the crypto market pattern, discussing the market trend and the strategic layout of the TRON ecosystem.

the signal of interest rate cuts is released, and the crypto market ushers in new opportunities?

After the Federal Reserve Chairman Powell's Jackson Hole meeting released a signal of interest rate cuts, global markets ushered in a violent shock. In Space, guests generally took a wait-and-see attitude towards the "interest rate cut" signal. Teacher Beidouxing used the word "moderation" to evaluate Powell's speech, believing that it was more like a "small stone" than a "big stone" thrown into a calm sea. He reminded investors that the Fed's decisions are still highly dependent on inflation and employment data, and if prices soar or unemployment rises in the future, the interest rate cut plan may be uncertain.

Mr. Xiao also pointed out that this statement is more of a "cautious test", and he believes that the most important value of this statement lies in the psychological impact: "The market is beginning to expect that the cost of funds may gradually decline, and risk appetite may be expected to rise", which will push investors to lay out risk assets in advance.

The crypto market is inherently endowed with high volatility genes, and although the risk is high, once the market rises, the profit margin is indeed larger than that of many traditional assets. If it enters the interest rate cut cycle, in the short term, the crypto market may become the most beneficial capital export, and Qi Kiss vividly describes the sensitive characteristics of the crypto market to liquidity with "funds drilling in like smelling it".

A number of experts specifically mentioned that after the expected interest rate cut, TRX and ETH took the lead in rebounding, believing that this reflects the market's recognition of high-quality public chain assets. With its growing ecological network, mature stablecoin market, large user base, and efficient transaction processing capabilities, TRON is becoming a shining star in this "interest rate cut storm".

TRX took the lead in rising, and the ecological value of TRON was recognized by the market In

thismarket environment, where the expectation of the Fed's interest rate cut is rising, Ethereum (ETH) and TRON (TRX) have performed well, and in this panel discussion, a number of experts analyzed the deep logic behind the rise of TRX assets, believing that this is not only a simple reaction of the market to macro signals, but also a rediscovery of its intrinsic ecological value.

Regarding TRON's performance, 77 believes: "TRX's rise is inseparable from stablecoins and ecological narratives. The USDT circulation on the TRON chain accounts for more than half of the world's circulation, providing solid fundamental support for the TRX price. He further emphasized: "The continuous expansion of TRON's ecological territory has also created more diversified application scenarios and value support for TRX."

Teacher Crypto.0824 also pointed out: "TRON has always maintained a leading edge in stablecoin issuance and ecological application construction" He pointed out that once the market expects liquidity to pick up, the demand for stablecoins will further increase, and the network effect of TRON will be re-amplified.

TRX's value support not only comes from the core needs of stablecoins and payment networks, but also benefits from its comprehensive ecosystem layout. Core ecological products such as the decentralized trading and asset issuance hub SUN.io, the lending protocol JustLend DAO, the Meme fair launch platform SunPump, the NFT issuance platform APENFT, the cross-chain protocol BitTorrent Chain, and the oracle network WINkLink jointly build a wide moat for TRON.

Specifically:

As the largest lending protocol on the TRON network, JustLend DAO has exceeded $8.55 billion in TVL, continuing to lead the market and providing users with efficient channels for fund utilization.

l SUN.io integrates core products such as SunPump and SunSwap to become the core hub of TRON ecological traffic aggregation and value flow, creating stable income for TRX holders through innovative mining mechanisms.

As a fair launch platform for Meme, SunPump truly realizes "co-creation for all" through the AI tool SunGenX, opens up the entrance of TRON ecological traffic, and connects a wider range of user groups.

l APENFT is the core NFT issuance platform of TRON, covering multiple scenarios such as NFT trading, GameFi, inscription asset deployment and trading, NFT fair issuance, and fractional liquidity.

l The WINkLink oracle network provides reliable price data support for the entire system and ensures the stable operation of the ecosystem.

l The BitTorrent Chain cross-chain protocol plays the role of an ecological bridge, realizing the free inflow and outflow of multi-chain assets, greatly expanding the boundaries and liquidity sources of the ecosystem.

Guests generally believe that in the context of interest rate cut expectations, the market will give priority to looking for TRX, an asset with both liquidity and fundamentals, as a breakthrough. With its absolute advantages in the field of stablecoins and its mature ecological matrix, TRON has become an important bridge connecting traditional finance and the crypto world. In the context of the imminent start of the interest rate cut cycle, TRON's infrastructure value and network effects will be further highlighted, providing investors with unique value capture opportunities.