If Kaito had a @ethena_labs-related mindshare list, I should at least have a decent ranking. In the past, when many people were bearish on shorting/hedging $ENA because the S4 season was coming to an end (September 24), their micro-strategy StablecoinX made a big move, announcing a refinancing of $530 million and repurchasing 13% of the total circulating supply in the next 6-8 weeks, suddenly pulling the currency price up again. @gdog97_ well done! $ENA I have mentioned this target many times, and there is a significant feature: 🤌 The team is especially good at making trouble, especially on BD, and the benefits saved are often shocking. 🤌 The performance is highly positively correlated with the market situation, and to a certain extent, it can be understood as a leveraged market currency, so the currency price fluctuates greatly with the emotional changes of the market. 🤌 Strong actuarial ability balances the income of large mining hedgers and the volatility of secondary...

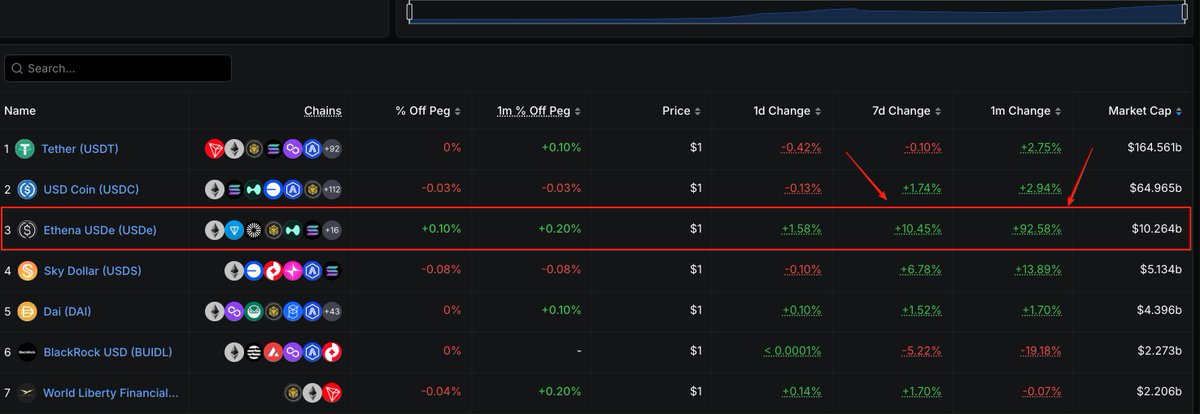

Woke up from a nap and $ENA continues to stir things up. Yesterday, I chatted with a few DeFi veterans about the strategy of @ethena_labs, and I feel that this team is truly the best at playing and has strategic vision among stablecoin teams. Because in the past month, their stablecoin growth has been incredibly impressive, standing out even among peers with single-digit growth. What does that mean? 5B shot straight up to 10B. While others are still trying to learn from their strategies from the last cycle to compete in CEX, they have already taken the lead in dominating the on-chain DeFi battlefield. This time, they chose to bind with @aave and @pendle_fi. Ethena splits USDe's Pt and Yt through Pendle and amplifies leverage for circular loans via Aave, not only achieving a rapid breakthrough of 10B in USDe issuance but also driving up the price of $ENA directly. Interestingly, the increase in $ENA has also boosted the profits from circular loan arbitrage (holding Yt earns S4's...

30.91K

21

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.