Frax Share price

in USD$1.399

-- (--)

USD

Last updated on --.

Market cap

$125.72M #134

Circulating supply

89.29M / 99.68M

All-time high

$11

24h volume

$5.87M

Rating

3.5 / 5

About Frax Share

FXS (Frax Share) is the governance and value-accrual token of the Frax ecosystem, a decentralized finance (DeFi) protocol known for its innovative stablecoin solutions. Frax combines algorithmic and collateral-backed mechanisms to maintain price stability, offering users a hybrid stablecoin model. FXS holders participate in key decisions and benefit from the protocol's revenue, including fees generated by Frax's stablecoins like frxUSD. The ecosystem also features yield-generating products such as sfrxETH and fxSAVE, designed to provide sustainable returns. Frax emphasizes security, scalability, and cross-chain accessibility, making it a versatile choice for users seeking stable assets and decentralized governance in DeFi.

AI insights

Frax Share’s price performance

Past year

-28.59%

$1.96

3 months

-61.12%

$3.60

30 days

-39.10%

$2.30

7 days

+6.79%

$1.31

Frax Share on socials

$AVICI is king.

Chill

$AVICI looks undervalued at $8M MC.

It’s an on-chain neobank that connects fiat and crypto. They already offer on-ramps and Visa cards so users can spend crypto IRL.

They are in position to disrupt an industry worth hundreds of billions and will be worth multiple trillions in 5-7 years.

Some quick takeaways:

• $35M of interest (still under $8M MC)

• Already live and generating revenue

• 4K users while in beta

• 9K signups

• $1M+ spent so far

• 70% MoM retention

• App available on Apple and Google stores

They are expanding into payrolls, merchant settlement, credit scores, mortgages, lending, and yield accounts.

This protocol is gaining users, attention, and traction as it fills a big gap. Bitcoin stared the world down a path of self sovereignty and ownership.

@AviciMoney closes the loop by providing non custodial banking services. We have seen individual projects/protocols, but never a full venue with a suite of offerings that can accelerate/underpin onchain finance.

Similar company’s like Revolut have raised $3B at a $75B valuation JUST THIS MONTH. Clearly, there is appetite for these kinds of products and a narrative that’s heating.

Not to mention, this token is unruggable through @MetaDAOProject’s futarchy system.

Token holders have 100% ownership of the value created by the company

Clean product.

Clean tokenomics.

Clear value to community.

Aligned, poised for growth, and ready to disrupt a massive industry in classic crypto fashion.

Again, I say: UNDERVALUED.

Hyperliquid Head Treasury Strategy Analysis: From High-Frequency Alpha to Risk Management

Author: @BlazingKevin_ , the researcher at Movemaker

The Vaults ecosystem on the Hyperliquid platform provides a unique window for investors to observe and participate in on-chain derivatives strategies executed by professional managers. This paper conducts a systematic quantitative analysis and strategic deconstruction of the most prominent head vaults in this ecosystem.

Evaluation framework and data methodology

For an objective and multi-dimensional comparison, we selected five representative vaults with the highest management scale and performance on Hyperliquid: AceVault, Growi HF, Systemic Strategies, Amber Ridge, and MC Recovery Fund.

Source: Hyperliquid

Our evaluation framework will revolve around the following core metrics to build a complete picture of each vault strategy:

Performance indicators: Total Earnings (PNL), Profits, Total Trades, Win Rate, Profit Factor.

Trading Efficiency Indicators: Average Profit and Loss, Average Profit, Average Loss per Deal.

Risk Management Metrics: Max Drawdown, Standard Deviation of Single P&L, P&L Volatility Ratio (i.e., Average P&L/Standard Deviation).

Strategy attribution metrics: P&L contribution of each currency, long and short position preference for specific coins.

In terms of data acquisition, we extracted the longest available historical transaction data for each vault stored by Hyperliquid. It is important to note that due to the platform's data storage limitations, the historical data period of the High Frequency Trading Vault (HFT) is relatively short, and the analysis window we can obtain ranges from three days to two months. For strategies that are traded less frequently, we can observe a longer historical performance.

AceVault Hyper01

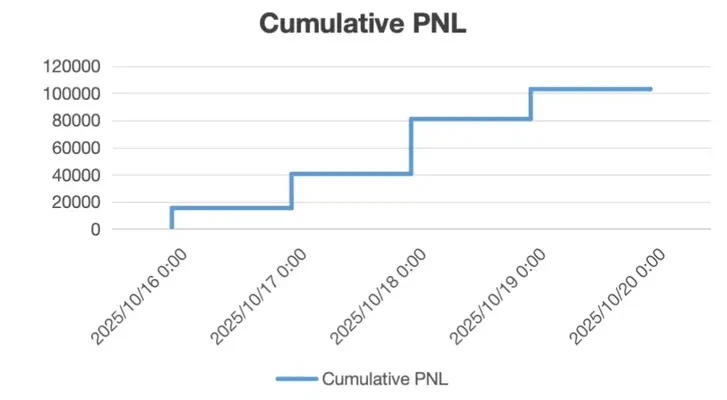

Analysis data period: October 16, 2025 - October 20, 2025

Source: Movemaker

1.1 Strategy overview and market position

AceVault Hyper01 is not only one of the largest strategic vaults in the Hyperliquid ecosystem by assets under management (TVL), but its performance is also remarkable. As of October 20, 2025, the vault's TVL has reached a whopping $14.33 million. Since its operation in August 2025, the strategy has achieved a cumulative profit of $1.29 million, with an annualized return (APR) of 127% in the past month, demonstrating strong and sustainable alpha generation capabilities.

1.2 Quantification of transaction behavior and performance

Over the four-day analysis period we selected, the vault recorded a total of 19,338 liquidations, providing us with a highly accurate sample of its strategy.

Core Performance Indicators:

Net Profit (Total PNL): +$103,110.82

Source: Hyperliquid; Production: Movemaker

Win Rate: 28%

Profit Factor: 3.71

Profit and loss structure analysis:

Average P&L (Avg. PNL): +$5.33

Average Profit Per Turn (Avg. Win): +$26.00

Average Loss per Transaction (AVG. Loss): $2.70

Risk indicators:

Max Drawdown: $791.20

Standard deviation of StdDev of PNL: 26.84

Profit and Loss Volatility Ratio (Avg. PNL / StdDev): 0.199

1.3 Strategy portrait and risk attribution

Strategy Portrait: High-frequency, asymmetric, systematic shorts

AceVault's trading frequency is at the top of all vaults and is part of the Very High Frequency Trading (HFT) strategy. With a win rate of just 28% and a profit/loss factor of 3.71, it presents a typical trend-following or momentum strategy characteristic: the strategy does not rely on a high win rate, but rather fully covers a large but tightly controlled loss (average loss of $2.70) with a few but profitable trades (average profit of $26.00).

This highly asymmetrical profit and loss structure is the core of its profit model.

Profit attribution: An all-around victory for altcoin bears

The strategy trades a wide range of assets (covering 77 assets), but its long-short operations show amazing consistency and discipline:

Long Operations: Execute only for three major assets: BTC, ETH, and HYPE.

Short Actions: Only short operations are performed on all other 74 altcoins.

Source: Hyperliquid; Production: Movemaker

During this analysis period, the sources of profit of the strategy are extremely clear:

Short Position: Cumulative profit +$137,804

Long position: Accumulated loss of $33,726

This indicates that AceVault's entire net profit comes from its systematic shorting on 74 altcoins. The largest profit contribution came from $FXS's short position (+$34,579), while the loss was concentrated in $HYPE's long position (-$16,100).

Risk management: ultimate loss control

This strategy demonstrates textbook-level risk management capabilities. With a TVL of $14.33 million and a frequency of nearly 20,000 trades, its maximum drawdown in four days is strictly controlled at $791.20, which is an extremely impressive figure. This aligns highly with the average single loss of -$2.70, demonstrating a systematic and extremely strict stop-loss mechanism built into its strategy.

1.4 Summary

AceVault Hyper01 is a high-frequency strategy with clear logic, strict enforcement, and high systematic. Its core model is to systematically execute a high-frequency short strategy by taking a long position in a basket of mainstream assets, potentially as a beta hedge or long-term position, while systematically executing a high-frequency short strategy across the broader altcoin market.

During the analyzed market cycle, the strategy's excess returns came entirely from its accurate capture of the decline in altcoins. Its top-of-the-line risk control system ensures that losses are strictly limited to a manageable and small range when executing a low-win strategy, resulting in a healthy and strong overall profitability.

Growi HF

Analysis data period: August 7, 2025 - October 20, 2025

Source: Movemaker

2.1 Strategy overview and market position

Growi HF is a strategic vault in the Hyperliquid ecosystem that has shown strong growth momentum. As of October 20, 2025, its total lock-up value has reached $5.1 million. The vault has been in operation since July 2024 and has a public track record of over a year, achieving a cumulative profit of $1.05 million. Its annualized return in the past month is as high as 217%, demonstrating its excellent alpha generation capabilities and strong profit explosiveness.

2.2 Quantification of trading behavior and performance

Our analysis is based on detailed trading data for the vault over the past two and a half months, during which a total of 16,425 liquidations were recorded, and its trading frequency remains highly active among similar vaults.

Core Performance Indicators:

Net profit: +$901,094

Source: Hyperliquid; Production: Movemaker

Win Rate: 38%

P&L Factor: 10.76

Profit and loss structure analysis:

Average P/L per Volume: +$54.86

Average Profit Per Action: +$159.00

Average Loss per Trade: $9.00

Risk indicators:

Maximum drawdown: $16,919

Standard deviation of a single profit and loss: 1841.0

P&L Volatility Ratio: 0.030

2.3 Strategy portrait and risk attribution

Strategy Portrait: The Ultimate Asymmetric "Bull Hunter" Similar to AceVault, Growi HF's profit model is also based on an asymmetric return structure, but in a more extreme form. With a win rate of 38% and a profit/loss factor of 10.76, it reveals the core of its strategy: to fully cover the majority (but with minimal losses) of trades with a few (but very profitable) trades.

Its profit and loss structure (average profit of $159 vs. average loss of -$9) is a perfect reflection of its strategy. This is a typical trend-following strategy of "cut losses short, let winners run".

Profit Attribution: Systematic Long Preference and Superior Asset Selection The trading behavior of this strategy shows a strong bullish bias. Of the 20 trading assets analyzed, only two-way operations were performed on $LTC, while the remaining 19 assets were only long.

Source: Hyperliquid; Production: Movemaker

Directional P&L: The vast majority of the strategy's profits come from long positions (cumulative profit +$886,000), while the only short exposure ($LTC) also contributes a small profit (+$23,554).

Coin P&L: The strategy has excellent asset selection capabilities. During the analysis period, all 20 assets it traded did not have a net loss. The position with the largest profit contribution came from the long position of $XRP (+$310,000), which was the core profit engine of the cycle.

Risk Management: Combination of Volatility Tolerance and Strict Stop-Loss Growi HF's risk management model is distinctly different from AceVault. Its standard deviation of a single profit and loss of up to 1841 suggests that the strategy does not attempt to smooth out PNL fluctuations on a single trade but is willing to endure significant profit variability in exchange for the opportunity to capture large profits ("Home Run").

However, this high tolerance for upside volatility contrasts with extreme intolerance for downside risk. -The average single loss of $9.00 and the maximum drawdown of only $16,919 (extremely low compared to a TVL of 5.1 million and a profit of 900,000) are strong evidence of its extremely effective risk control mechanism, capable of systematically and stifling losses before they widen.

2.4 Summary

Growi HF is a highly asymmetric, long-driven trading strategy. It does not pursue a high win rate, but uses an extremely strict loss control system (average loss of only $9) to "hunt" for high-explosive bull trends (average profit of $159).

During the analyzed market cycles, the strategy demonstrated strong profitability and near-perfect asset selection in the bullish direction (0 loss-making assets). The subtlety of its risk model is that it successfully combines "high volatility per PNL" with "systematic downside risk protection" to achieve excellent risk-adjusted returns.

Systemic Strategies

Analysis data period: October 13, 2025 - October 20, 2025

Source: Movemaker

3.1 Strategy overview and market position

Systemic Strategies is a strategy vault in the Hyperliquid ecosystem with a significant management scale and a long operating history. As of October 20, 2025, its total lock-up value stands at $4.3 million. Operational since January 2025, the vault boasts a track record of over nine months and has accumulated $1.32 million in earnings, a testament to the historical effectiveness of its model over longer periods.

However, its annualized return (APR) for nearly a month is only 13%, a data that suggests a significant slowdown in the strategy's recent profitability.

3.2 Analysis of recent (past week) trading performance

The following is an in-depth analysis based on the vault's 11,311 closed transactions over the past week. The data clearly shows that the strategy has encountered serious headwinds in the recent market environment, leading to a significant performance drawdown.

Core Performance Indicators:

Net Profit: -$115,000

Source: Hyperliquid; Production: Movemaker

Win Rate : 22%

P&L Factor : 0.56

Profit and loss structure analysis:

Average P&L: -$10.22

Average profit per trade: +$61.00

Average Loss per Trade: $30.00

3.3 Strategy portrait and risk attribution

Strategy Portrait: Failed Asymmetric Model The treasury's break-even factor is well below the break-even point of 1.0, which is a direct quantitative reflection of its net loss during the current cycle.

However, a crucial detail is hidden in the profit and loss structure: the strategy's average profit per transaction (+$61) is still twice as high as the average single loss (-$30). This shows that the "asymmetric return" logic at the design level of its strategy (i.e., earning more when making a profit and controlling losses when it loses) itself has not been destroyed.

Therefore, the huge losses in this cycle are not due to the failure of risk management (such as stop loss), but from the catastrophic misalignment of signal generation or market timing, resulting in a very low win rate of only 22%. In other words, the strategy's trading system generated a large number of false trading signals during the week, and although the cost of each wrong stop loss was manageable, its cumulative effect eventually crushed the profit.

Risk exposure and performance attribution The strategy has been under significant pressure recently, as evidenced by its risk indicators:

Risk exposure: The maximum drawdown during the analysis period is up to $128,398. This value almost equals or even exceeds the total loss for the week, indicating that the strategy has experienced a sharp pullback in funds that did not recover during the analysis period.

Directional attribution: Losses are widely distributed in both long and short positions. Among them, the cumulative loss of short orders was $94,800, and the cumulative loss of long orders was $23,953. This strongly suggests that the strategy has been running against market conditions during this analysis period, whether it is bullish or bearish signals.

Currency attribution: Of the 56 coins traded, the majority recorded losses. The largest single-currency loss came from $PENDLE's long position (-$22,000), while the largest single-currency gain came from $LDO's long position (+$13,000), but the size of individual gains was far from enough to offset the broad losing side.

Source: Hyperliquid; Production: Movemaker

3.4 Summary

Systemic Strategies' long-term track record of profitability demonstrates the historical effectiveness of its models. However, the performance data of the last week provides us with a typical example of the failure of a strategy model in a specific market environment.

The strategy has been challenged by both long and short signals in the current market cycle, leading to a serious collapse on the win rate side (rather than the profit-loss ratio structure side), and ultimately triggering a significant drawdown. This performance can be seen as a significant stress test for the strategy's model, providing a clear reveal of its vulnerability to specific market conditions.

Amber Ridge

Analytics Data Period: July 12, 2025 - October 20, 2025 (Full Policy Lifecycle)

Source: Movemaker

4.1 Strategy overview and market position

Amber Ridge is a strategy vault with a very clear and distinctive style in the Hyperliquid ecosystem. As of October 20, 2025, its total lock-up value is $2.5 million. Since its inception in July 2025, the vault has achieved a cumulative profit of $390,000, with an annualized return of 88% in the past month, showing significant profit potential.

4.2 Trading behavior and strategy portrait

The following analysis is based on all 4,365 historical transactions of the vault since its inception, which provides us with a complete deconstruction of its strategy.

Strategy Portrait: Clear "Long Mainstream, Short Copycat" Structure The portrait of this strategy is extremely clear, manifested as a typical "long mainstream, short copycat" hedging or relative value structure. Among the 28 assets traded, the strategy is extremely disciplined:

Long Operations: Execute only for three mainstream assets: Bitcoin, Ethereum, and SOL.

Short Operations: Only short operations are performed on the remaining 25 altcoins.

4.3 Profit and loss structure analysis

Core Performance Indicators:

Net profit : +$390,000

Source: Hyperliquid; Production: Movemaker

Win Rate: 41%

P&L Factor: 1.39

Profit and loss structure analysis:

Average P&L : +$90.00

Average Profit per Deal : +$779.00

Average Loss per Transaction : $389.00

The strategy's P&L factor of 1.39 indicates that it is in a healthy profitable state. Its profit and loss structure (average profit +$779 vs. average loss -$389) is a typical embodiment of the discipline of "truncating losses and letting profits run". Unlike the high-frequency strategy, the average single loss of this strategy is larger in absolute terms, but its explosive power on the profit side is enough to cover these losses.

4.4 Risk analysis: high volatility and huge drawdown

While this strategy achieves significant returns, it also comes with extremely high risk exposure.

Risk Exposure: Its historical maximum drawdown is up to $340,000.

Key Insight: This drawdown value is nearly equal to the strategy's cumulative total profit ($390,000). This reveals the strategy's extreme volatility and vulnerability, with investors historically facing extreme risks of giving back almost all of their profits.

Performance Volatility: The standard deviation of a single P&L is as high as 3639, while the P&L volatility ratio is only 0.024. This extremely low value confirms that the strategy's profitability does not come from stable small accumulations, but relies heavily on a few huge profitable trades to set up a win.

4.5 Profit attribution analysis

Directional P&L: The entire net profit of the strategy comes from its long positions. The data shows that the cumulative profit of long orders is $500,000, while the cumulative loss of short orders is $110,000. This data clearly shows that during the analyzed market cycle, the gains of going long mainstream coins far outweighed the losses of shorting altcoins.

Currency profit and loss: high concentration of profit and loss The performance of this strategy shows extreme concentration:

Maximum Profit: Originated from a long position in $ETH, contributing a profit of +$320,000. This deal contributed almost 82% of the total profit.

Maximum Loss: A short position originating from $PYTH, resulting in a loss of $180,000.

Source: Hyperliquid; Production: Movemaker

4.6 Summary

Amber Ridge is a "long mainstream, short copycat" strategy with clear logic but extremely high risk. Its historical performance demonstrates the model's significant profitability during specific market cycles, where mainstream assets rise faster than altcoins.

However, investors must be soberly aware of its risk-reward characteristics:

High concentration of profits: The success of the strategy depends almost entirely on a handful of "home run" trades (especially $ETH longs).

Huge potential drawdown: The strategy comes with a significant potential drawdown risk that is almost equal to its total profit.

This is a typical "high-risk, high-reward" strategy, and its performance is highly dependent on the market beta and the timing ability of managers, and is only suitable for investors with strong risk tolerance.

MC Recovery Fund

Analysis Report Analysis Data Period: August 10, 2025 - October 20, 2025 (Full Policy Lifecycle)

Source: Movemaker

5.1 Strategy Overview and Market Position

MC Recovery Fund is a highly strategically focused strategy vault in the Hyperliquid ecosystem. As of October 20, 2025, its total lock-up value stands at $2.42 million. Since its inception in August 2025, the vault has accumulated a profit of $450,000, with an annualized return of 56% over the past month, showing solid returns.

5.2 Trading behavior and strategy portrait

The following is based on the analysis of all 1,111 historical transactions of the vault since its launch. Its trading frequency is the lowest among the five vaults analyzed, clearly reflecting its non-high-frequency, more selective trading style. The strategy is highly focused, operating only four assets: Bitcoin, Ethereum, SOL, and HYPE.

Strategy Style: Excellent Long-Short Profitability The vault demonstrates exceptional long-short two-way alpha capture capabilities. Specifically:

Execute long-short two-way trades on $BTC and both are profitable.

Perform only long positions on $ETH and $HYPE, both profitable.

Perform only short positions on $SOL to achieve profitability.

This shows that the strategy does not simply follow the market beta, but holds a clear and preset directional judgment on specific assets based on its independent investment research framework.

5.3 Profit and loss structure analysis

Core Performance Indicators:

Net profit: +$450,000

Source: Hyperliquid; Production: Movemaker

Win Rate: 48%

P&L Factor : 43.1

Profit and loss structure analysis:

Average P&L : +$404.00

Average Profit Per Action: +$862.00

Average Loss per Trade: $18.00

The strategy's win rate (48%) is close to breakeven, but its break-even factor stands at a staggering 43.1. This is an extremely rare and outstanding value that is the core cornerstone of the strategy's success, meaning that its cumulative total profit is more than 43 times the cumulative total loss. Its profit and loss structure is nothing short of perfect: the average single loss is tightly controlled at a staggering -$18, while the average single profit stands as high as +$862.

5.4 Risk analysis: ultimate risk control

The strategy's risk management capabilities are its most prominent highlight.

Risk Exposure: Its all-time maximum drawdown is just $3,922. Compared to its cumulative earnings of $450,000 and TVL of $2.42 million, this drawdown is minimal and almost negligible.

Performance Volatility: Despite the high standard deviation of a single P&L (2470), this does not stem from runaway risk, but is driven entirely by a handful of hugely profitable exchanges. The extremely low average loss (-$18) and the tiny maximum drawdown together demonstrate that the strategy is extremely consistent and consistent on the risk side (i.e., losing trades).

5.5 Profit attribution analysis

Directional P&L: The strategy has achieved significant and balanced profits in both long and short directions. The cumulative profit of long orders is $240,000, and the cumulative profit of short orders is $210,000. This proves that this is a mature ** "all-weather" strategy that can adapt to different market directions. **

Currency P&L: All four coins traded are profitable. Among them, $HYPE's long position contributed the largest single-coin profit (+$180,000) and was one of the core sources of profit for the strategy.

Source: Hyperliquid; Production: Movemaker

5.6 Summary

The MC Recovery Fund is a textbook-level example of risk management. It does not pursue high-frequency trading or high win rates, but captures alpha through a near-perfect, highly asymmetrical profit and loss structure for long-term stable growth.

At the heart of its success lies the fact that the vast majority of losing trades are tightly controlled within a minimal, fixed range (-$18 on average) through a highly disciplined system while allowing profitable positions to fully develop. It is a high-quality strategy with a high level of maturity and very low risk, suitable for investors looking for solid returns.

summary

Through in-depth quantitative analysis of Hyperliquid's top five vaults (AceVault, Growi HF, Systemic Strategies, Amber Ridge, MC Recovery Fund), we were able to see through the surface of high APRs and total profits to gain insight into the core of their strategy – not all high yields are created equal.

Source: Hyperliquid; Production: Movemaker

Our analysis reveals several key conclusions:

Risk control, not win rate, is the cornerstone of a top-tier strategy: Contrary to conventional perception, the most successful vaults in this analysis do not rely on high win rates (AceVault 28%, Growi HF 38%, MC Recovery 48%). Instead, their triumph stems from a common, strictly enforced logic: an asymmetric profit and loss structure.

A model of "asymmetric victory": The MC Recovery Fund is the epitome of this model. Its P&L factor of 43.1 is staggering, and behind it is near-perfect risk control: an average loss of just $18 per trade, while an average profit of +$862. The same is true for Growi HF (P&L factor 10.76). This shows that their profitability model is not based on "winning more times", but on "only minor injuries when you lose, and capturing huge returns when you make a profit".

Maximum drawdown is a "stress test" of the strategy: the two columns of "maximum drawdown" and "proportion of drawdown" in the comparison chart clearly divide the robustness of the strategy.

MC Recovery Fund (drawdown $3,922) and AceVault (drawdown $791) demonstrate textbook risk control, with the largest drawdown in history being almost negligible.

In contrast, Amber Ridge's retracement is as high as $340,000, accounting for 87% of its total earnings, meaning investors have experienced extreme volatility with almost "zero profits." Systemic Strategies' recent retracement of $128,000 has also exposed the fragility of its model.

Alpha comes from different sources: Strategies for success vary in their paths. AceVault systematically shorts altcoins for profit through high-frequency trading; Growi HF is an aggressive bull hunter, capturing trends under strict risk control; The MC Recovery Fund, on the other hand, has demonstrated mature long-short equilibrium capabilities and is an "all-weather" strategy. This is a testament to the depth of the Hyperliquid ecosystem, allowing different types of alpha strategies to coexist.

For investors, evaluating vaults must not just look at the APR at face value. The true value of a strategy lies in its risk management capabilities revealed by its profit and loss factor and maximum drawdown. In Hyperliquid's high-volatility, high-leverage arena, an asymmetrical profit and loss structure is at the heart of achieving long-term profitability, and extreme risk control is the only path to this victory.

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation and jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of Aptos' Chinese-speaking ecosystem. As the official representative of Aptos in the Chinese-speaking region, Movemaker is committed to creating a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and many ecological partners.

Disclaimer:

This article/blog is for informational purposes only, represents the author's personal opinion, and does not represent the position of Movemaker. This article is not intended to provide: (i) investment advice or investment recommendations; (ii) an offer or solicitation to buy, sell, or hold Digital Assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, is extremely risky, with high price volatility and can even become worthless. You should carefully consider whether trading or holding digital assets is right for you based on your financial situation. For specific questions, please consult your legal, tax or investment advisor. The information provided herein, including market data and statistics, if any, is for general information purposes only. Reasonable care has been taken in the preparation of these data and charts, but we are not responsible for any factual errors or omissions expressed therein.

Guides

Find out how to buy Frax Share

Getting started with crypto can feel overwhelming, but learning where and how to buy crypto is simpler than you might think.

Predict Frax Share’s prices

How much will Frax Share be worth over the next few years? Check out the community's thoughts and make your predictions.

View Frax Share’s price history

Track your Frax Share’s price history to monitor your holdings’ performance over time. You can easily view the open and close values, highs, lows, and trading volume using the table below.

Frax Share FAQ

Currently, one Frax Share is worth $1.399. For answers and insight into Frax Share's price action, you're in the right place. Explore the latest Frax Share charts and trade responsibly with OKX.

Cryptocurrencies, such as Frax Share, are digital assets that operate on a public ledger called blockchains. Learn more about coins and tokens offered on OKX and their different attributes, which includes live prices and real-time charts.

Thanks to the 2008 financial crisis, interest in decentralized finance boomed. Bitcoin offered a novel solution by being a secure digital asset on a decentralized network. Since then, many other tokens such as Frax Share have been created as well.

Check out our Frax Share price prediction page to forecast future prices and determine your price targets.

Dive deeper into Frax Share

FXS is the non-stable utility token in the protocol, holding rights to governance.

Disclaimer

The social content on this page ("Content"), including but not limited to tweets and statistics provided by LunarCrush, is sourced from third parties and provided "as is" for informational purposes only. OKX does not guarantee the quality or accuracy of the Content, and the Content does not represent the views of OKX. It is not intended to provide (i) investment advice or recommendation; (ii) an offer or solicitation to buy, sell or hold digital assets; or (iii) financial, accounting, legal or tax advice. Digital assets, including stablecoins and NFTs, involve a high degree of risk, can fluctuate greatly. The price and performance of the digital assets are not guaranteed and may change without notice.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

OKX does not provide investment or asset recommendations. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition. Please consult your legal/tax/investment professional for questions about your specific circumstances. For further details, please refer to our Terms of Use and Risk Warning. By using the third-party website ("TPW"), you accept that any use of the TPW will be subject to and governed by the terms of the TPW. Unless expressly stated in writing, OKX and its affiliates (“OKX”) are not in any way associated with the owner or operator of the TPW. You agree that OKX is not responsible or liable for any loss, damage and any other consequences arising from your use of the TPW. Please be aware that using a TPW may result in a loss or diminution of your assets. Product may not be available in all jurisdictions.

Market cap

$125.72M #134

Circulating supply

89.29M / 99.68M

All-time high

$11

24h volume

$5.87M

Rating

3.5 / 5