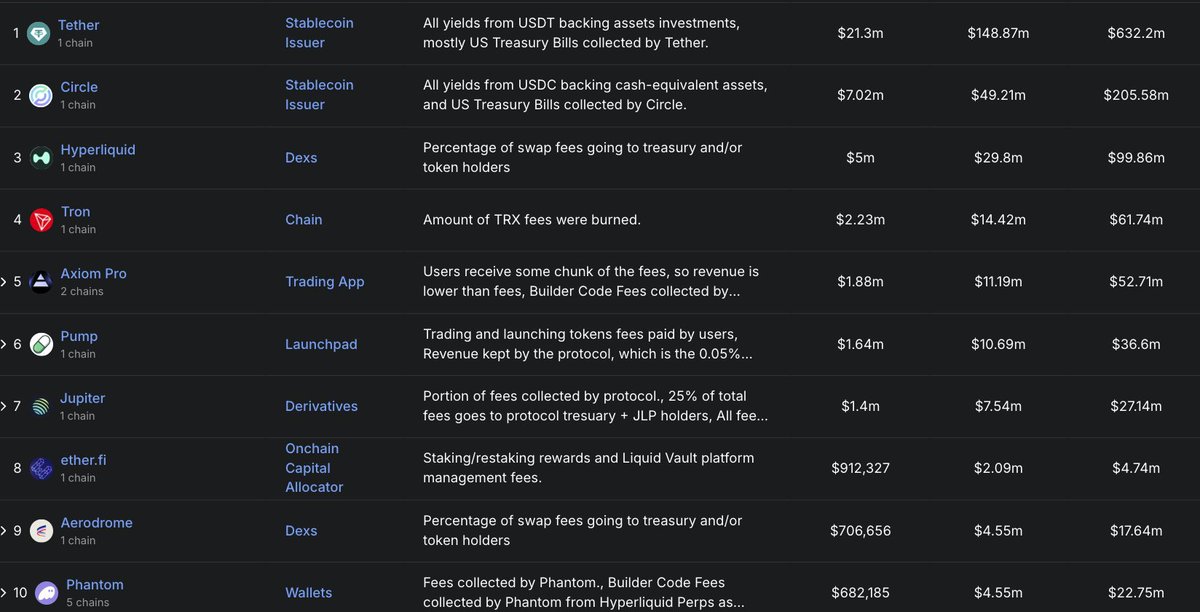

The most profitable sector in the crypto market earns tens of millions of dollars daily. What opportunities can retail investors gain from these companies' profits? The top ten most profitable crypto projects:

1. Tether, with a daily income of $20 million, derives its revenue from the investment of USDT's reserve assets, primarily U.S. Treasury bonds, collected by Tether. Related project: upcoming plasma (XPL).

2. Circle, with a daily income of $7 million, generates revenue from cash-equivalent assets backed by USDC and the earnings from U.S. Treasury bills collected by Circle. Related project: U.S. stock CRCL.

3. Hyperliquid, with a daily income of $5 million, earns from trading fees, but a portion of the trading fees is distributed to the treasury or HYPE holders. Related project: platform token HYPE.

4. Tron, with a daily income of $2 million, generates revenue from on-chain transaction fees that are used to burn TRX. Related project: public chain compared to TRX.

5. Axiom Pro, with a daily income of $1.88 million, earns from Builder Code Fees collected from Hyperliquid Perps.

6. Pump, with a daily income of $1.64 million, derives its revenue from transaction and token issuance fees paid by users, with the protocol retaining income, specifically a 0.05% protocol fee on each transaction. Related project: PUMP.

7. Jupiter, with a daily income of $1.4 million, generates revenue from fees collected by the protocol, including withdrawal fees and management fees, treasury and token holder income, and fees collected by Jup Studio. Related project: JUP.

8. With a daily income of $900,000, revenue comes from staking/re-staking rewards and management fees from the Liquid Vault platform. Related project: ETHFI.

9. Aerodrome, with a daily income of $700,000, earns from swap fees. Related project: platform token AERO.

10. Phantom, with a daily income of $680,000, generates revenue from dex interaction fees. Related project: none.

Show original

8.87K

0

The content on this page is provided by third parties. Unless otherwise stated, OKX is not the author of the cited article(s) and does not claim any copyright in the materials. The content is provided for informational purposes only and does not represent the views of OKX. It is not intended to be an endorsement of any kind and should not be considered investment advice or a solicitation to buy or sell digital assets. To the extent generative AI is utilized to provide summaries or other information, such AI generated content may be inaccurate or inconsistent. Please read the linked article for more details and information. OKX is not responsible for content hosted on third party sites. Digital asset holdings, including stablecoins and NFTs, involve a high degree of risk and can fluctuate greatly. You should carefully consider whether trading or holding digital assets is suitable for you in light of your financial condition.